Control the Digital Landscape: Comprehensive Google Business Profile Management Services

Control the Digital Landscape: Comprehensive Google Business Profile Management Services

Blog Article

Gain an One-upmanship With Specialist GBP Management Strategies

In the realm of worldwide finance, the skilled monitoring of GBP holdings stands as an important variable that can dramatically impact the trajectory of a business or investment portfolio. From navigating intricate market patterns to purposefully hedging against possible threats, the techniques used in GBP management can make all the difference in acquiring a competitive side.

The Significance of GBP Administration

Properly taking care of GBP is critical for making certain monetary stability and long-term success in any company or investment endeavor. The management of GBP, or Excellent British Pound, entails very carefully keeping an eye on exchange prices, market fads, and economic signs that can affect the worth of the money. By remaining notified and positive in GBP management, services can reduce dangers related to currency changes and enhance their financial efficiency.

One vital reason that GBP monitoring is crucial is the effect it has on global profession. For businesses taken part in importing or exporting products and solutions, fluctuations in the GBP currency exchange rate can directly impact the expense of transactions and profitability. By properly handling GBP direct exposure with hedging approaches or other danger monitoring techniques, companies can secure their lower line and remain affordable in the global market.

Additionally, GBP monitoring plays a crucial role in financial investment profiles. Financiers holding properties denominated in GBP are revealed to money risk, which can wear down returns if not correctly taken care of. By proactively keeping an eye on and adjusting GBP placements based on market conditions, financiers can improve profile diversity and general efficiency. To conclude, the importance of GBP administration can not be overstated, as it is a vital element in keeping monetary health and attaining sustainable development in today's vibrant service atmosphere.

Analyzing Market Trends and Information

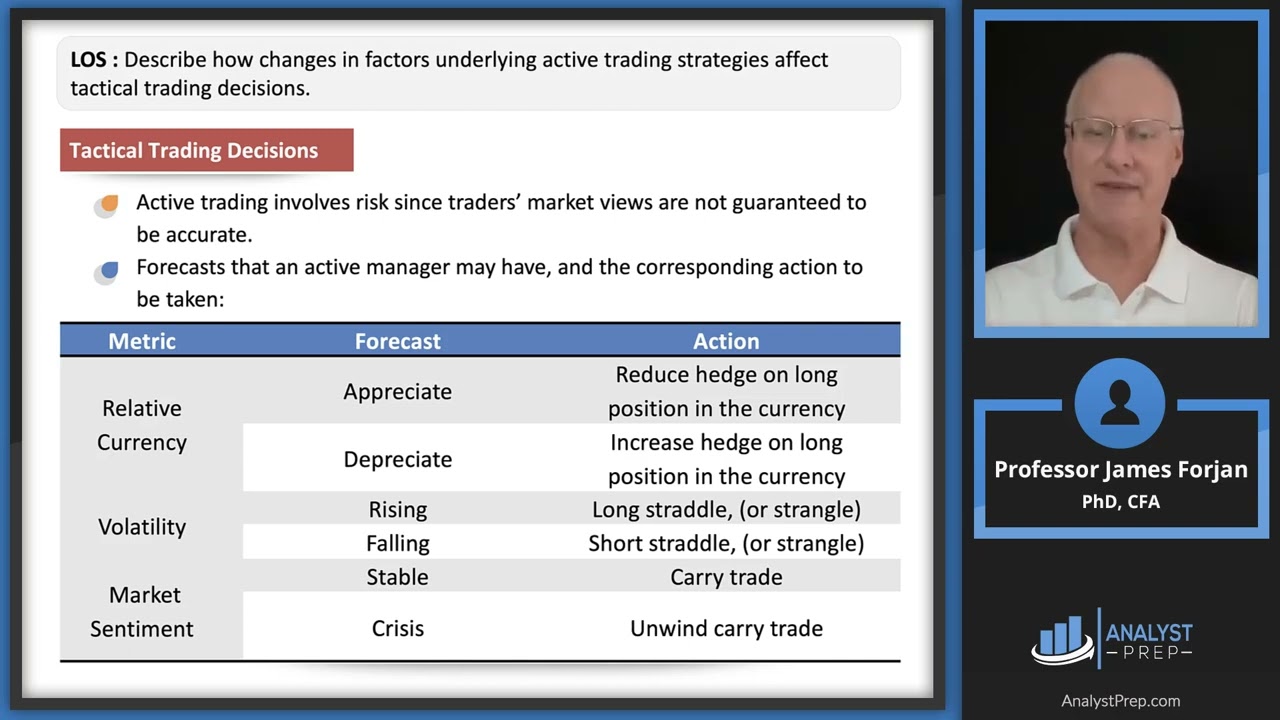

Offered the integral volatility of the GBP exchange rate and its straight influence on capitalists and organizations, an important aspect to consider is the precise analysis of market trends and data. By diving into market fads, one can determine patterns and changes in the GBP's value, enabling informed decision-making. Keeping a close eye on economic signs, political developments, and global events that influence the money's efficiency is crucial for staying in advance in GBP management. Making use of innovative analytical devices and remaining upgraded on market information can offer useful understandings into possible future activities of the GBP, assisting in threat mitigation techniques. Recognizing the relationship between market trends and the GBP exchange rate can help financiers and businesses expect market shifts and change their methods as necessary. In today's hectic global economic climate, integrating a data-driven strategy to assessing market patterns is extremely important for successfully handling GBP direct exposure and maximizing economic results.

Carrying Out Hedging Strategies

Creating a comprehensive hedging technique is essential for organizations and financiers seeking to navigate the unpredictabilities of the GBP currency exchange rate effectively. Hedging approaches involve making use of financial tools or strategies to offset possible losses from negative rate motions. For handling GBP-related risks, organizations can use various hedging devices such as like it ahead agreements, choices, or currency swaps.

Onward contracts allow entities to lock in a currency exchange rate for a future purchase, protecting them from negative currency movements. If the market moves favorably, alternatives provide the adaptability to either proceed with the exchange at an established price or opt-out - linkdaddy GBP management. Currency swaps involve exchanging capital in various money to minimize currency exchange rate risk

When executing hedging strategies, it is vital to evaluate the cost-benefit evaluation, considering variables like purchase prices, hedging tool liquidity, and the degree of protection required. Regular surveillance and changes to the hedging method are likewise necessary to make certain positioning with changing market conditions and organization objectives. By using effective hedging methods, organizations and investors can much better handle GBP exchange rate variations and acquire a competitive edge in the marketplace.

Leveraging Foreign Exchange Devices and Platforms

Using innovative foreign exchange tools and systems is vital for optimizing GBP monitoring techniques in today's dynamic market setting. Making use of innovative technological options can offer investors and services with an one-upmanship by providing real-time information analysis, progressed charting capabilities, and automated trading functionalities. google business profile management. Platforms such as MetaTrader 4 and 5, cTrader, and TradingView offer a wide variety of tools that can assist in monitoring market fads, executing trades, and handling danger effectively

Foreign exchange tools like financial calendars, volatility indications, and relationship matrices enable market participants to stay notified concerning essential financial occasions, examine market belief, and determine prospective opportunities commercial. Additionally, algorithmic trading systems and expert advisors can assist simplify trading procedures and make sure timely implementation based on fixed requirements.

Monitoring Political and Financial Occasions

Conclusion

To conclude, reliable GBP management is vital for gaining an one-upmanship on the market. By evaluating market patterns, implementing hedging techniques, leveraging forex tools and systems, and monitoring economic and political occasions, businesses can make educated choices to secure versus currency fluctuations and take full advantage of profits. It is necessary for companies to stay aggressive and tactical in their strategy to GBP administration to remain ahead of the competition.

Comprehending the relationship between market fads and the GBP exchange rate can assist organizations and investors prepare for market changes and change their techniques accordingly.In the world of GBP monitoring techniques, staying abreast of economic and political occasions is important for making educated choices in the ever-changing market landscape. Understanding how these events affect the money markets can help GBP managers prepare for market movements and readjust their methods accordingly.

Report this page